21+ How To Calculate Rental Income For Child Support

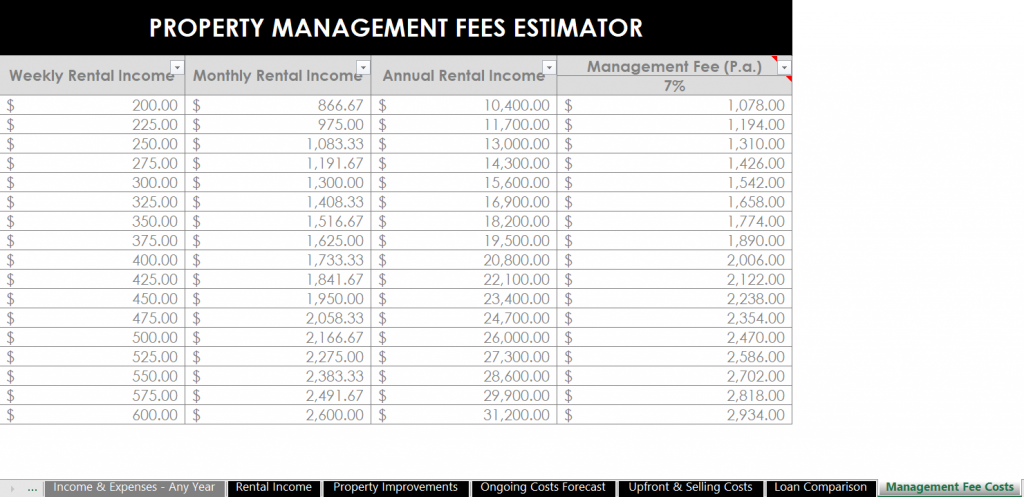

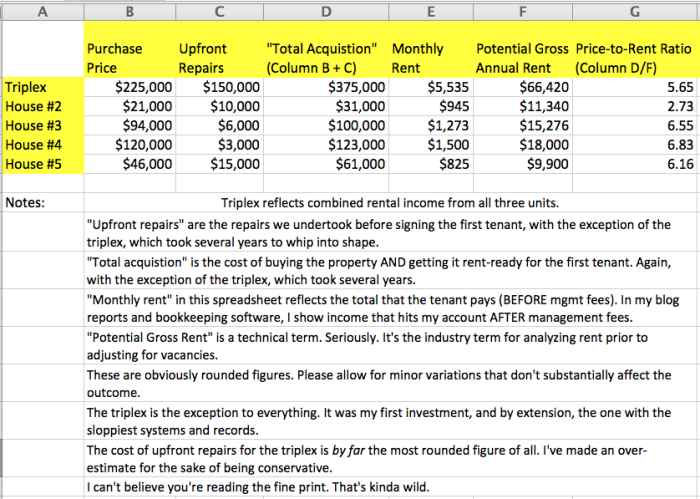

Net rental income from real property line 12600. 2022 down from 94000 per month in 2021.

![]()

Free 10 Income Tracker Samples In Pdf

The period from when she first used her home to produce income until she sold it is 2374 days.

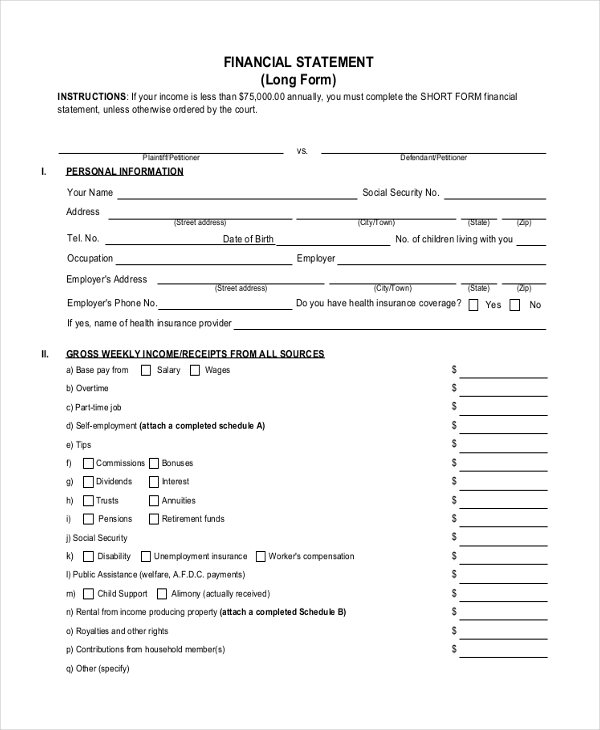

. Youre allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent and then to maintain it as a rental. PART 3--Earned Income Tax Credit Sec. Capital and interest or interest only.

SSI was created by the Social Security Amendments of 1972 and is incorporated in Title 16 of the Social Security ActThe program is administered by the Social. At the company level its the companys revenue minus the cost of good sold. Enter losses on line 26 _____ 20.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. Using the guidelines to calculate the proper child support amount to pay. Download 108 KB 24.

Download 18 KB 23. Earned Income Tax Credit EIC Child tax credits Student loan interest deduction. A child of the individual who is under 18 years of age at the end of the year.

Download 47 KB 25. The individuals spouse or common-law partner. To calculate your MAGI find the AGI from your tax returnits on line 11 of the newly redesigned Form 1040.

Income from rental property. 11212022 Governor Parson Proclaims November Adoption Awareness Month. The child received over half of his or her support for 2021 from the parents and the rules on Multiple support agreements later dont apply.

Homebuyers race to capture recent drop in mortgage rates. 468 and section 24 of the Egg Products Inspection Act 21 USC. Apply for support or make a payment.

The average rate on the 30-year fixed mortgage falling 60 basis points from 722 to 662 on Thursday. B If the obligors monthly net resources are less than the amount described by Section 154125c in lieu of performing the computation under the preceding section the court may determine the child support amount for the children before the court by applying the percentages in the table below to the obligors net resources. There is a need to recalculate your child support payments if you initially based the amount on your income as this may change.

Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairmentFor more information go to Order alternate formats for persons with disabilites or call 1-800-959-8281. Gross income or gross pay is an individuals total pay before accounting for taxes or other deductions. A dependent child who receives more than 1150 in investment income tax year 2022 is required to file a tax return.

Also the support payments you previously paid and deducted for the year in which you paid them but that were later repaid to you and that you included as income for 2020 line 12800 _____ 21. It can also include practical support such as the use of a vehicle or room and board. If you are outside Canada and the United States call 613-940-8495We only accept collect calls made through.

A dependent child who has earned more than 12950 of earned income tax year 2022 typically needs to file a personal income tax form. Approved PIAs provided in HTML and downloaded PDF format. Fatima used her home to produce income from 1 November 2015 to 1 August 2019 a total of 1370 days.

This can include providing financial support through savings employment or pension income or by borrowing. Child Abuse or Neglect. With a capital and interest option you pay off the loan as well as the interest on it.

12 The first calculated amount in the medical expense tax credit formula relates to eligible medical expenses paid by the individual in respect of. The majority of Canadian parents plan to support their childrens education in a range of ways. Read latest breaking news updates and headlines.

Industry professional and technical services added 28000 jobs while business support services lost. Total taxable support payments you received in 2020. Download 652 KB 26.

Parents support for their childrens educations. Live Basic will be able to file a limited IRS Schedule 1 if they have hobby income or personal property rental income reported on a Form 1099-K andor a limited IRS Schedule D if they have personal item sales income reported on Form 1099-K. Monthly job growth in professional and business services has averaged 58000 thus far in.

Employment showed little change over the month in mining and wholesale trade. There are two different ways you can repay your mortgage. For CGT purposes Fatima is taken to have acquired the house on 1 November 2015.

695 section 25 of the Poultry Products Inspection Act 21 USC. Application of child tax credit in possessions. View the latest business news about the worlds top companies and explore articles on global markets finance tech and the innovations driving us forward.

Download 18 KB 22. Those filing in TurboTax DeluxeTurboTax Live. Either of the following applies.

Fatimas assessable capital gain is 40000 1370 2374 23083. Foster Care Adoption. Get information on latest national and international events more.

The child is in custody of one or both of the parents for more than half of 2021. Medical expenses for individual spouse or common-law partner and children under 18. The Child Tax Credit changes for 2021 have lower income limits than the original Child Tax Credit.

Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles. Yes rental income is taxable but that doesnt mean everything you collect from your tenants is taxable. Families that do not qualify for the credit using the revised income limits are still eligible for the 2000 per-child credit using the.

Supplemental Security Income SSI is a means-tested program that provides cash payments to disabled children disabled adults and individuals aged 65 or older who are citizens or nationals of the United States. Support of a child received from a parents spouse is treated as provided by the parent. 1053 and any regulations promulgated by the Department of Agriculture implementing such.

Listing of privacy impact assessments. Earned income includes wages tips salaries and payment from self-employment. Then use Appendix B Worksheet 1.

Earned Income Tax Credit EIC Child tax credits.

Car Rentals In Germany From 14 Day Search For Rental Cars On Kayak

21 Printable Rental Application Templates

Biggest Child Support Myths In Florida Ayo And Iken

What Does Annual Income Mean When Applying For A Credit Card

Economic And Social Data Service Esds

The Excel Spreadsheets I Use To Manage My Investment Property Income Expenses Tax Deductions The Loan Etc

Varda Epstein Author At Kars4kids Small Grants

Biggest Child Support Myths In Florida Ayo And Iken

How To Calculate Rental Income The Right Way Smartmove

Child Support Calculation Regarding Rental Income San Bernardino Legal Answers Avvo

How To Use The Online Child Support Calculator Meriwether Tharp Llc

Human Services Resource Guide Somerset County

How Much Can You Earn From A Rental Property

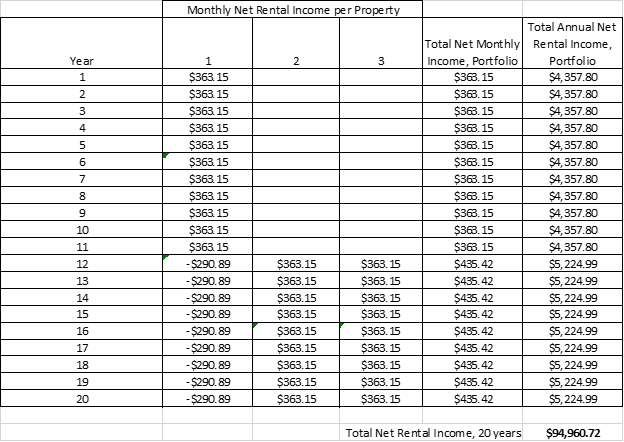

The Age Old Investment Question Stocks Or Real Estate Part Iv Rental Income Revisited And Stock Market Returns Seeking Alpha

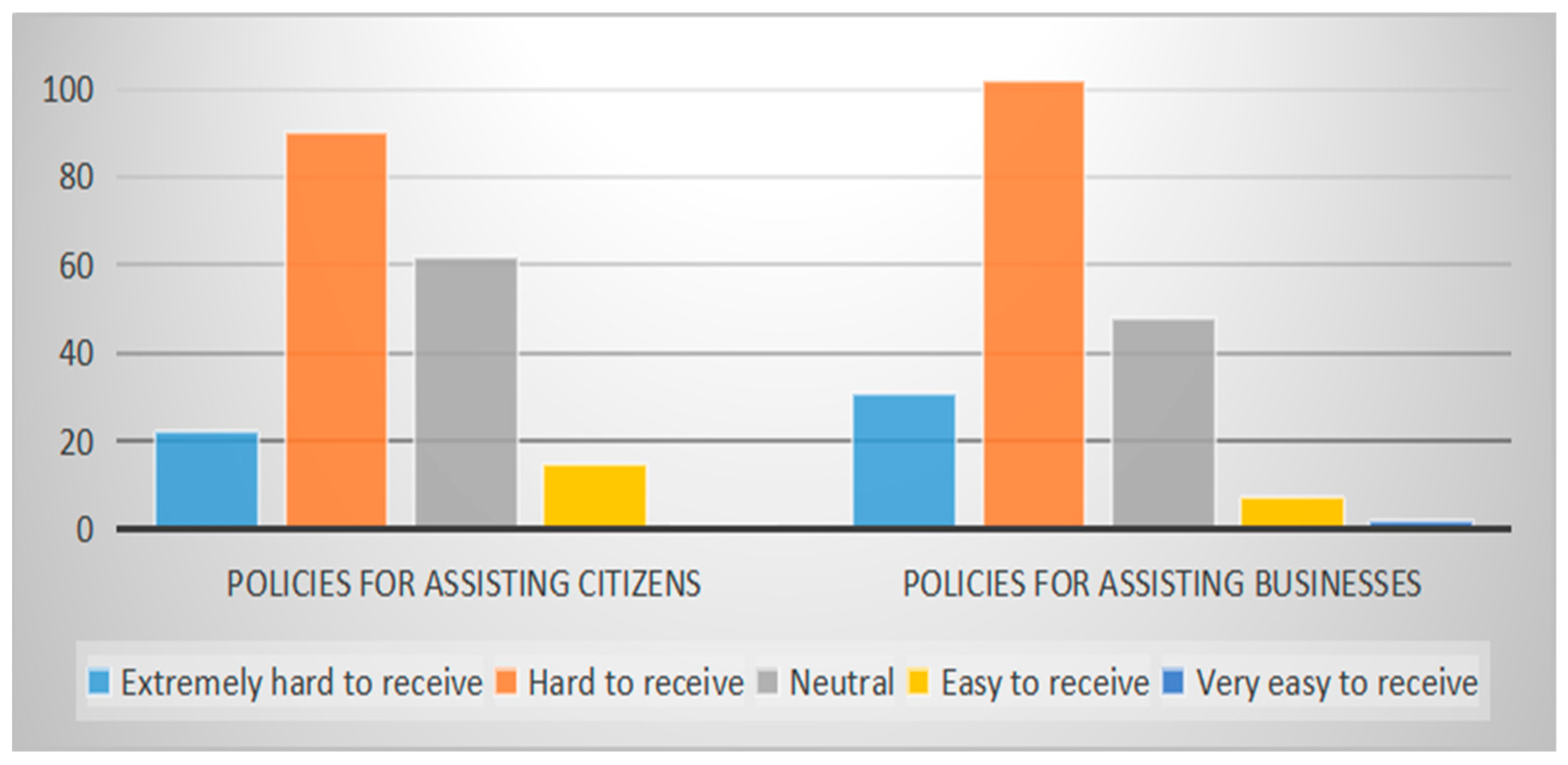

Economies Free Full Text Assuring Social Equity And Improving Income From An Assessment Of Government S Supports In A Pandemic And Migrant Workers Integration In Vietnam

Pin On Real Estate

Cohousing Inclusive Selbstorganisiertes Gemeinschaftliches Wohnen Fur Alle